In recognition of Tax Day, IER is taking a big-picture look at some of the more wasteful energy programs funded by Americans’ tax dollars. The energy sector, in particular, is replete with examples of bad programs and frivolous spending, including tax credits and loan guarantees for expensive and unreliable sources of energy. Instead of the government trying to pick winners and losers, a consumer-focused approach that allows energy sources to win or lose on their merits would be better for Americans.

Direct Expenditures and Tax Credits

Direct expenditures (i.e., cash payments) and tax credits for renewable energy sources are the most costly taxpayer-funded energy subsidies, according to data from the U.S. Energy Information Administration (EIA). These programs cost billions of dollars annually and include nearly 700 duplicative or overlapping renewable energy initiatives.

The two most notable tax expenditures are the solar Investment Tax Credit (ITC) and the wind Production Tax Credit (PTC)—both of which were extended for five years by Congress in December 2015 for an estimated cost of $23.5 billion. Neither of these policies are new: the wind PTC has existed since 1992; the solar ITC’s two distinct credits for residential and commercial properties were created in the 1970s and were either revived or expanded in the Energy Policy Act of 2005. A provision in the ARRA also established the Section 1603 Program, which offers a cash grant in lieu of the ITC or PTC for qualified technologies. The program cost taxpayers about $25 billion through 2015.

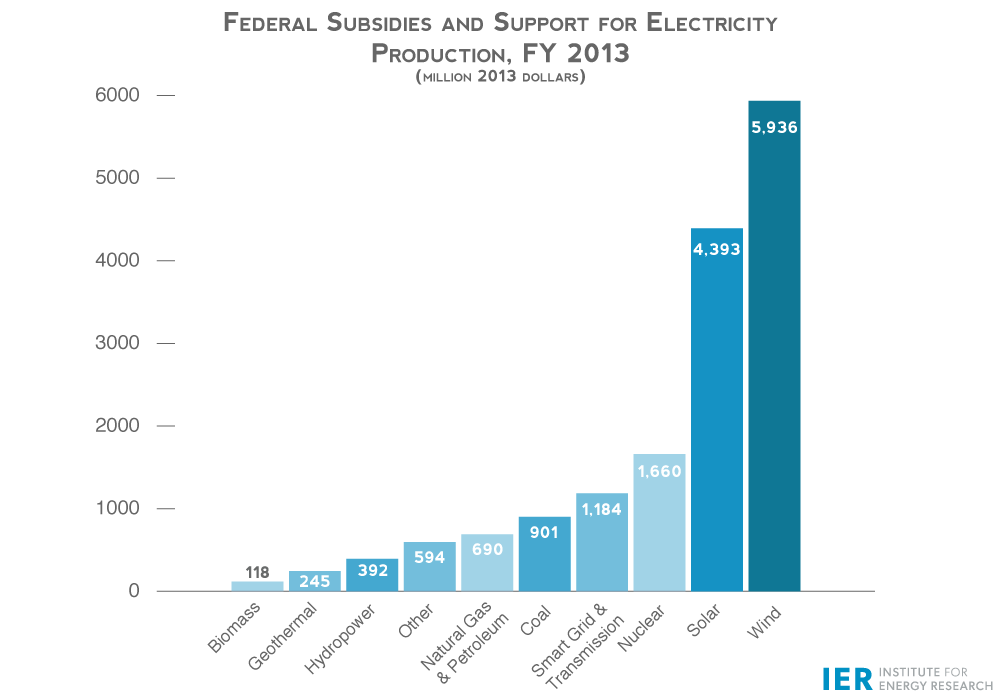

Based on a 2015 report by EIA, wind energy in fiscal year (FY) 2013 received more subsidies than any other source ($5.9 billion).

Source: Energy Information Administration, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013,

March 2015, http://www.eia.gov/analysis/requests/subsidy/; also see,

http://instituteforenergyresearch.org/analysis/eia-subsidy-report-solar-subsidies-increase-389-percent/

In addition, solar energy received the most subsidies on a unit of production basis ($231.21 per MWh), based on data from EIA’s report.

Source: Energy Information Administration, Direct Federal Financial Interventions and Subsidies in Energy in Fiscal Year 2013,

March 2015, http://www.eia.gov/analysis/requests/subsidy/; also see,

http://instituteforenergyresearch.org/analysis/eia-subsidy-report-solar-subsidies-increase-389-percent/

New taxpayer-subsidized solar and wind electricity is significantly more expensive than electricity from existing coal, natural gas, and nuclear power plants. New wind resources cost nearly three times more than existing coal, and new solar resources are about four times as costly.[1] Despite receiving billions of dollars in subsidies, solar and wind contributed less than 6 percent of U.S. electricity generation in 2015.

But tax credits aren’t limited to solar panels or large wind turbines: there are a number of smaller energy credits (e.g., geothermal heat pumps, fuel cells, small wind, etc.) that some lawmakers tried to attach to a Federal Aviation Administration reauthorization bill. Extending these tax credits would be a wasteful continuation of misguided energy policy. While lawmakers failed to attach this to the FAA bill, they will continue to look for ways to extend these subsidies.

Furthermore, nuclear energy is also eligible for a production tax credit for new nuclear plants that are operational by January 1, 2021. According to EIA’s report, nuclear received about $1.1 billion in tax credits for FY 2013.

An important consideration for tax credits is also whether energy sources are being treated similarly under the tax code relative to other industries. For instance, although the oil and gas industry has been accused of receiving special handouts in the form of tax deductions, these deductions are comparable to provisions that are generally available to other manufactures. The tax deductions for the oil and gas, industry are available to other industries and businesses in the U.S. as well. (See this post and this post for a fuller explanation of these deductions).

The most significant tax deductions for oil and gas producers are the percentage depletion allowance and the expensing of intangible drilling costs, which primarily help independent producers rather than big oil companies. IER supports broad-based tax reform that would eliminate targeted tax credits and deductions for all firms, but in the meantime, the tax code should treat oil and gas producers the same as it treats the rest of U.S. businesses or comparable industries like manufacturing. Ultimately, government policies shouldn’t distort energy markets, and the tax code shouldn’t favor or disenfranchise particular sources for political ends.

Loan Guarantees

The federal Department of Energy (DOE) offers loan guarantees for energy technologies, particularly to “accelerate the deployment of innovative clean energy projects.” Currently, DOE’s Loan Programs Office (LPO) accepts applications for two programs—the Title XVII Innovative Clean Energy Projects Loan Program and the Advanced Technology Vehicles Manufacturing Loan Program. LPO’s portfolio lists 30 projects totaling over $31 billion in federal support.[2] For context, DOE’s loan program is what supported the failed Solyndra project, which lost taxpayers around $535 million.

Loan guarantees are used to help companies or startups receive capital to get their projects off the ground. To encourage lenders to give out loans to new, risky projects, the government agrees to pay back the loan if the borrower defaults (in reality many of the loans are actually from the Federal Financing Bank). Loan guarantees reduce the risk for banks and lessen the responsibility on companies and investors. That sounds good, except for the fact that it transfers risks from the private sector to taxpayers who will now bear the costs if the projects fail. According to the U.S. Government Accountability Office (GAO), DOE’s “programs can expose the government and taxpayers to substantial financial risks if borrowers default.” In November 2014, DOE estimated that the expected net cost over the life of the loans would be $2.21 billion. In other words, loan guarantees shift costs from companies onto taxpayers.

Beyond just the burden placed on taxpayers, the need for loan guarantees is dubious. One 2012 study by the Mercatus Center looked at DOE’s 1705 loan guarantee program and found underwhelming results:

- Few long-term jobs were created;

- Well-established companies were primarily granted loans;

- Large companies that received loans often double-dipped by obtaining grants from other federal programs.

Based on the results of that study, loan guarantees didn’t create growth in emerging sectors but instead padded the pockets of bigger companies that shouldn’t be dependent on handouts.

Furthermore, an analysis by The Heritage Foundation’s Nick Loris reviewed each project in the DOE’s loan portfolio, demonstrating how such programs distort investment opportunities and place undue risk on taxpayers. One company, Abengoa Bioenergy, received two DOE loan guarantees totaling $2.65 billion for the Mojave and Solana solar projects, but now it’s requesting “another $1.85 billion in creditor support to avoid bankruptcy.”[3] Those two projects were also granted $890.6 million under the Treasury’s Section 1603 Program.[4]

Nuclear power has also benefited substantially from loan guarantees. Now, existing nuclear power plants are very reliable, provide the lowest cost electricity at $29.6 per MWh on average, and have the highest average capacity factor of any electricity resource. Nevertheless, because of high upfront capital costs (partly from the cost of licensing), nuclear plants typically seek government loan guarantees and the Obama administration has authorized a $12.5 billion loan guarantee program for nuclear reactors.

Nuclear power is an important part of the U.S. energy mix. Rather than having taxpayers financially support the construction and licensing of new reactors, the government should reform the permitting process and improve nuclear waste management to reduce unnecessary costs and make it easier for the private sector to invest in a clean, reliable energy source.

Conclusion

Every year on Tax Day, Americans are reminded about the very real impact of taxation on their lives. While the government does need to fund important activities, limiting the amount of wasteful spending on energy subsidies can lessen the burden on families and businesses. Rather than picking winners and losers through subsidies, federal and state policies should let energy sources compete on the free market and stand—or fall—on their own merits.

[1] The levelized cost of electricity for solar resources will be included in a forthcoming update to IER’s report, The Levelized Cost of Electricity from Existing Generation Resources, http://instituteforenergyresearch.org/analysis/what-is-the-true-cost-of-electricity/.

[2] As of April 15, 2016. See, DOE, Portfolio Projects, http://energy.gov/lpo/portfolio-projects.

[3] Nick Loris, Examining the Department of Energy’s Loan Portfolio, Testimony before the House of Representatives Committee on Science, Space and Technology’s Subcommittee on Energy and Subcommittee on Oversight, March 3, 2016, http://www.heritage.org/research/testimony/examining-the-department-of-energys-loan-portfolio.

[4] See, the List of Awards for Section 1603 Projects documented by the Department of the Treasury, https://www.treasury.gov/initiatives/recovery/Pages/1603.aspx.

The post This Tax Day, Remember the High Costs of Energy Subsidies appeared first on IER.

No comments:

Post a Comment