This week, the Institute for Energy Research submitted the following comment on the Obama administration’s proposed Five Year Offshore Oil and Gas Leasing Program for 2017-2022:

The Institute for Energy Research believes that the proposed 5-Year Leasing Program for 2017-2022 is wholly inadequate for the nation’s needs. In the findings of the Outer Continental Shelf Lands Act, Congress declared that “the outer Continental Shelf is a vital national resource reserve held by the Federal Government for the public, which should be made available for expeditious and orderly development, subject to environmental safeguards, in a manner which is consistent with the maintenance of competition and other national needs.” This plan fails to meet the intent of the law that the OCS be made available for expeditious and orderly development and does not meet the nation’s needs.

Why is Access to Energy Resources Important?

Before we comment on the OCS leasing program, it is first important to understand why access to energy resources is critical. The short answer is that the world has inexpensive oil prices today (ie. $45 a barrel instead of $100+ a barrel) because of U.S. oil production (with some help from Canada).

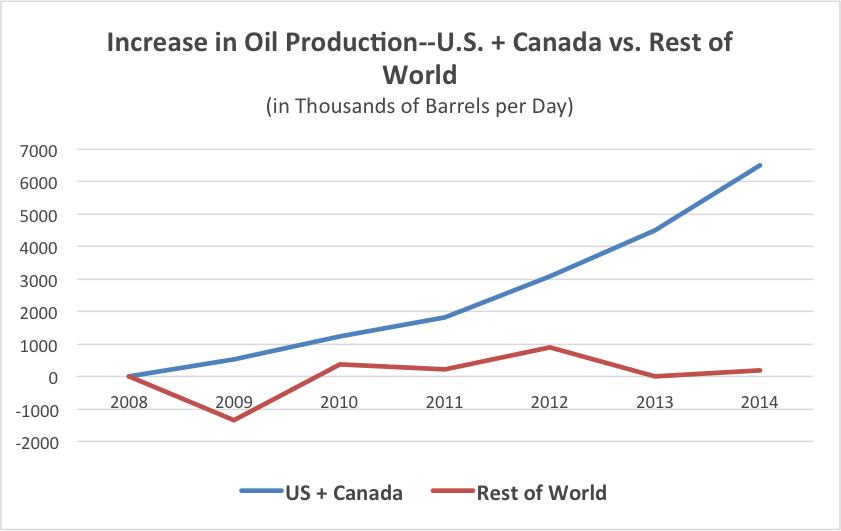

From 2008 through 2014, 97 percent of the total increase in world oil production came from the U.S. and Canada alone.[1]

From 2008 through 2014 (the most recent year for which data is available), world oil production increased by 6.686 million barrels per day. Fully, 6.491 million barrels per day of that increase came from the U.S. and Canada. In fact, 5.457 million barrels a day or 82 percent, came from the U.S. alone.

Production on federal lands and offshore areas, however, as not kept up with production on private lands. According to data from the U.S. Extractive Industries Transparency Initiative from 2008 through 2014, oil production on federal lands and waters increased by 26 percent.[2] That sounds like a nice increase, however, the sum total of the increase happened from 2008 to 2009. From 2009 through 2014, oil production actually fell by 0.2 percent. The record of the Obama administration on oil production is abysmal, and this plan simply continues that record for another five years.

The U.S. led the way on oil production and the result is much lower oil prices. This production, as government data shows, came from private and state lands, not federal lands. If the federal government controlled all of the subsurface resources in the United States, the world would almost certainly have oil that costs $150 a barrel instead of less than $50 a barrel. After all, Energy Information Administrator Adam Sieminski said, “If we did not have the growth in North Dakota, in the Eagle Ford and the Permian, oil could be $150 (per barrel).”[3] The key to sustainably low oil prices is access to energy resources. This OCS program, however, does not provide much access.

The OCS Proposed Program

Even prior to the decision to remove the Atlantic Lease Sale from the draft, this plan was the most anemic offshore leasing program proposed in decades, in that it offered the fewest number of lease sales. As a consequence of removing the Atlantic Sale, it concentrates an entire nation’s lease sale program in a small portion of Alaska and Central and Western Gulf of Mexico. The over reliance on just a portion of the Gulf of Mexico for nearly the entire U.S. OCS leasing program time after time—which this five year plan proposes—is a serious geological, economic and historical mistake. The Gulf of Mexico is the most hurricane-prone area of the country, and placing all—or nearly all—of the government’s leasing in this area—and excluding leasing in other parts of the 1.76 billion acres of federal holdings in the OCS is short-sighted and foolhardy.

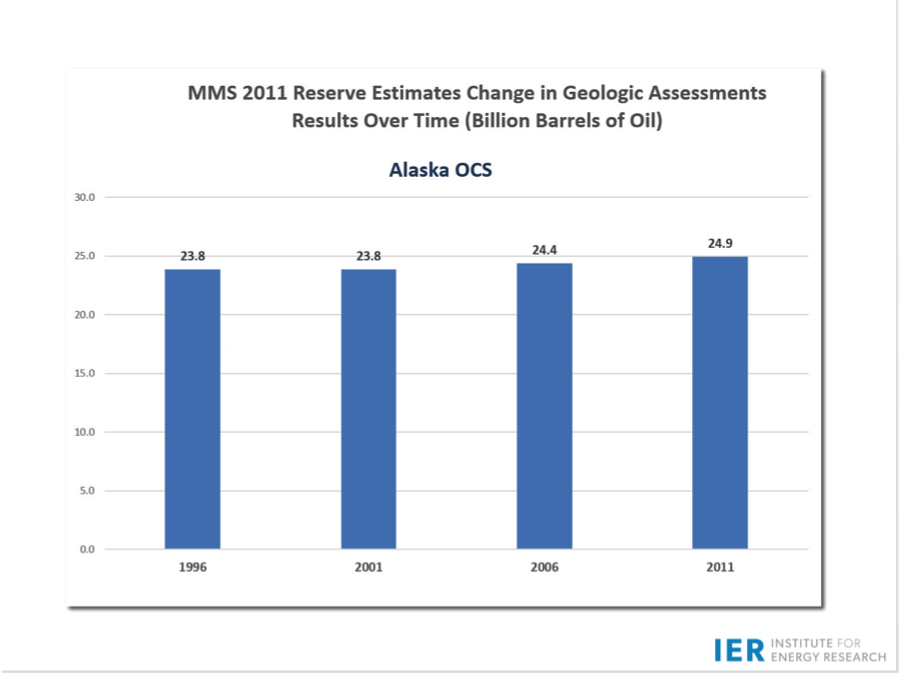

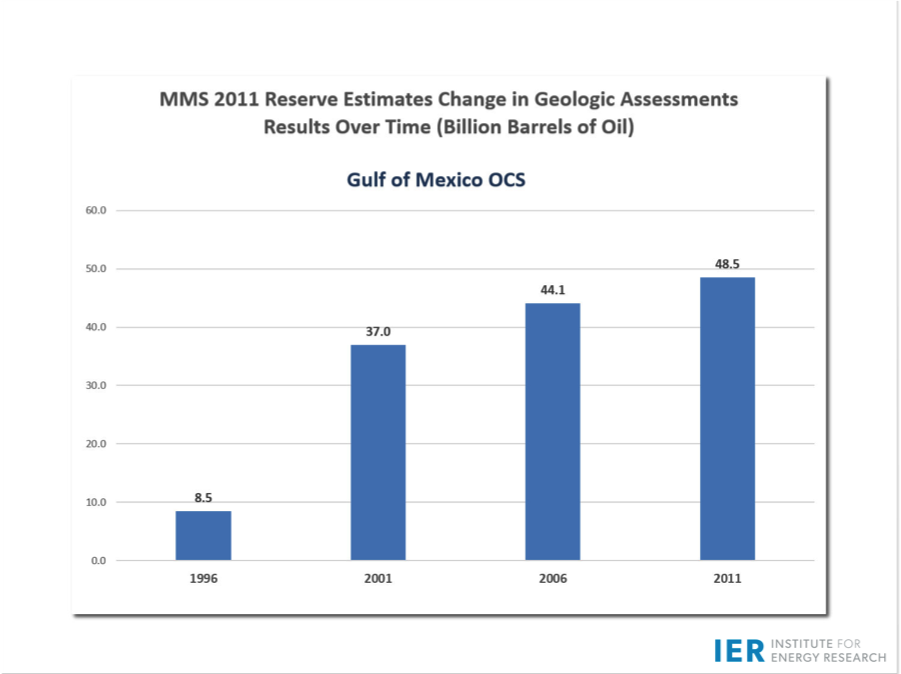

The consequences of such an underwhelming 5-year plan means that knowledge that could be advanced about our nation’s oil and gas potential will be put off for that much longer. Consider the following charts showing the change in geological estimates over time of Alaska’s OCS versus the Gulf of Mexico:

The difference is that there has been far greater leasing in the Gulf of Mexico than the Alaska OCS and as a result the reserve estimates have nearly sextupled in the Gulf of Mexico while remaining essentially stagnant in the Alaska OCS.

The lack of access to energy resources means that jobs that might have been created in areas of the country where lease sales might have been held will not be created. It means that investments that might have been made in the United States will instead be made in foreign nations and off their shores, where leasing is encouraged. It means that Americans—who might have been working here at home and buying more of their energy resources from their own supplies—will continue to rely on foreign sources for more of their energy supplies than is necessary for a longer period of time.

Large Economic Benefits of Oil and Gas Production

The Institute for Energy Research is very familiar with the history of federal energy leasing and its benefits to our national economy. Interestingly many of the benefits of leasing are in the short term, rather than the long term, as is the common understanding. Clearly, royalties do not flow immediately from holding lease sales, but the sooner the lease sales happen, the sooner multiple economic benefits occur. And those benefits are massive. The current 5-year plan postpones all of those benefits and jobs for Americans and deprives state, local and federal governments of enormous amounts of revenue.

In Dr. Joseph Mason’s December 2015 study of the extended benefits of opening to energy leasing those areas closed to leasing, he found that the continuing economic benefits, including benefits to economic growth, wages, jobs and federal, state, and local tax revenues from opening federal lands and waters to oil, gas and coal leasing would produce the following:[4]

- GDP would increase by $127 billion annually in the next seven years, and $663 billion annually in the next thirty years

- $20.7 trillion cumulative increase in economic activity over the next thirty-seven years, simply by allowing Americans to go to work producing energy

- 552,000 jobs would be created annually over the next seven years, with 2.7 million jobs annually over the next thirty years

- $32 billion increase in annual wages over the next seven years, with a cumulative increase of $5.1 trillion over thirty-seven years

- The federal government would receive an additional $3.9 trillion in federal tax revenues over thirty-seven years, while state and local tax revenues would rise by $1.9 trillion over the same time period.

While his study included onshore lands and coal leasing, a huge amount of this potential increase to our national economy and our jobs would flow from a much more robust 5-year plan. This is the opportunity cost to our economy of the most anemic leasing plan in decades.

Conclusion

The Institute for Energy Research believes it is time for the Department of Interior through the BOEM to take its obligations to taxpayers, the nation’s well-being and our nation’s security seriously. This plan is a far cry from a serious response to the serious economic, energy and national security challenges our nation faces in the future. The American people deserve better.

[1] Energy Information Administration, International Energy Statistic: Total Oil Supply, https://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=53&aid=1&cid=regions&syid=2008&eyid=2014&unit=TBPD

[2] The United States Extractive Industries Transparency Initiative, Federal Production, https://useiti.doi.gov/explore/federal-production/#year=2009&product=Oil+(bbl)

[3] Ernest Scheyder, UPDATE 1-Oil prices would hit $150/barrel without U.S. shale, EIA says, Reuters, Sept. 24, 2014, http://www.reuters.com/article/eia-forecast-idUSL2N0RP1PP20140924.

[4] Dr. Joseph Mason, The Economic Effects of Immediately Opening Federal Lands to Oil, Gas, and Coal Leasing, Institute for Energy Research, Dec. 2015, http://instituteforenergyresearch.org/studies/the-economic-effects-of-unlocking-federal-lands/.

The post IER Submits Comment on Proposed Offshore Leasing Program appeared first on IER.

No comments:

Post a Comment