Environmentalists have been actively pursuing banning the use of hydraulic fracturing in order to keep oil and natural gas in the ground rather than fueling our vehicles, heating our homes, keeping the lights on, as well as the air conditioners humming. In the 2016 election, Monterey, California approved a measure to ban the use of hydraulic fracturing, which was on its ballot.[i] But, if its use is banned nationally, the impact would be major. The U.S. Chamber of Commerce found that by 2022 the ban would cost the country 14.8 million jobs, almost double gasoline and electricity prices, and increase the cost of living by almost $4,000.[ii]

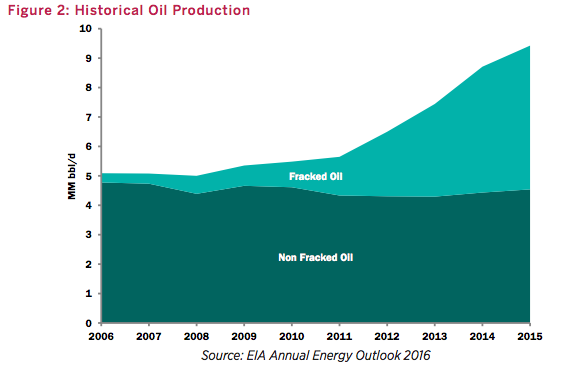

Hydraulic fracturing used in conjunction with directional drilling has resulted in the oil and natural gas renaissance we enjoy today and much lower oil and natural gas prices. Hydraulic fracturing pumps water and sand into rock (shale and reservoir rock) to break it allowing the oil and gas to be captured. Its use has almost doubled U.S. production of oil and natural gas between 2008 and 2015, making the United States the largest natural gas producer in the world and one of the top three oil producers.

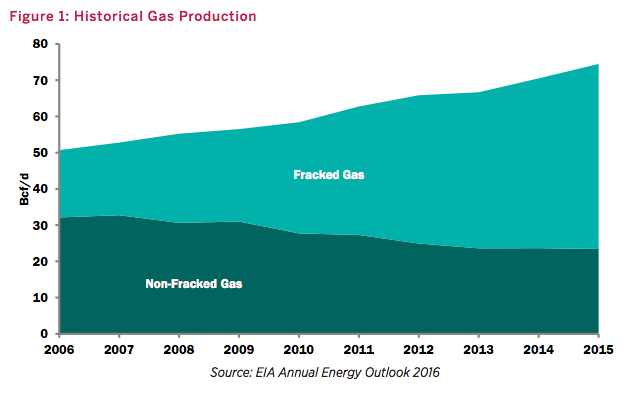

Today, almost 70 percent of our natural gas is produced using hydraulic fracturing, compared to 37 percent in 2006, and 52 percent of our oil is produced using hydraulic fracturing, compared to 6 percent in 2016, as depicted in the charts below.

Source: http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

Source: http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

The Chamber of Commerce Report

The Chamber of Commerce analyzed what would happen if hydraulic fracturing was banned nationally between the start of 2017 through the end of 2022. It examined the impact on jobs, energy prices, incomes, domestic manufacturing, and energy security. It found that:

- The United States would lose 14.8 million jobs by 2022—3.8 million jobs in 2017 alone. There are 509,000 jobs lost in the oil and gas sector. The 14.8 million job losses are broken out as follows: 4.1 million due to higher residential energy costs, 8.8 million due to higher business energy costs, and 1.9 million due to upstream production losses.

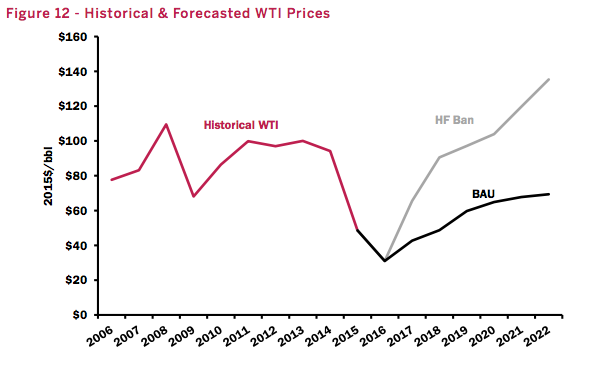

- Gasoline and diesel prices would increase by 53 percent in 2017 and double by 2022.

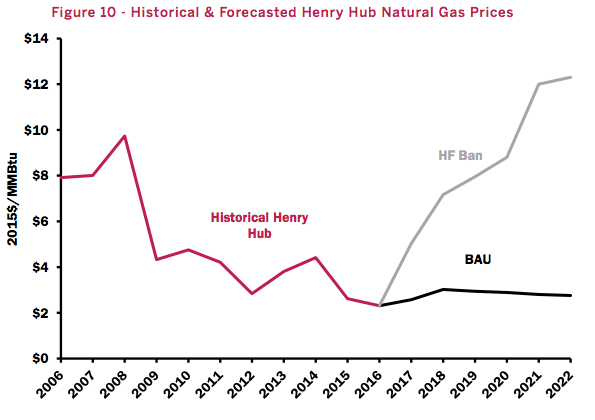

- Natural gas prices would increase to $12 per million Btu and would be 400 percent higher in 2022 than the baseline price.

- Electricity prices would almost double by 2022 due mainly to increased natural gas prices.

- S. GDP would lose $1.6 trillion by 2022–$442 billion in 2017 alone (a decline of 2.5 percent from 2015).

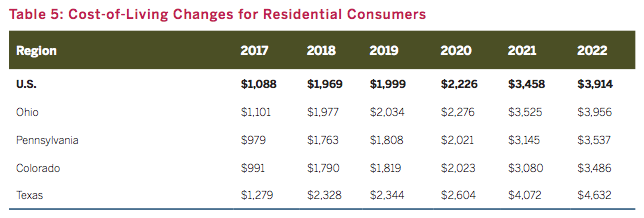

- Cost of living would increase by almost $4,000 in 2022 and household incomes would decline by $873 billion.

- The United States would no longer be a global energy super power being replaced by Russia and OPEC.

- Texas, Pennsylvania, Ohio, and Colorado would be among the hardest hit states.

To get these results, the Chamber started with the High Oil and Gas Resource and Technology Case from the Energy Information Administration’s (EIA’s) Annual Energy Outlook 2016, which it believes more realistically represents oil and gas production in the past. To that, the Chamber assumed a ban on hydraulic fracturing beginning in 2017 and applied decline rates for hydraulically fractured wells based on the Eagle Ford and Haynesville basins. The Chamber also assumed that imports and exports could return to previous historic levels.

If hydraulic fracturing is banned, there would be far less domestic production of oil and natural gas resulting on an increased reliance on imported energy to meet domestic energy needs, exposing the United States to the whims of foreign suppliers and to international price volatility. The United States would be forced to import LNG to make up the difference between consumption of natural gas and production plus net pipeline imports. Thus, the United States would no longer be able to become a net natural gas exporter.

Oil and natural gas prices in this situation would be based on scarcity as supply would be significantly reduced and demand would be fairly inelastic in the short-term. By 2020, Henry Hub natural gas prices rise to levels experienced before 2008 and then increase further to over $12 per million Btu in 2020. EIA’s Annual Energy Outlook reference case has Henry Hub prices remaining at $5 per million Btu or less through 2040 due largely to the use of hydraulic fracturing. (See chart below.)

Source: http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

The global crude oil market has been in an oversupply situation since 2014 when U.S. shale oil production became the marginal oil supplier globally. The Chamber expects the total affected U.S. oil production to be 1.75 million barrels per day in 2017, which would result in a tight global oil market. The Chamber expects oil prices to return to their 2010 to 2014 levels and then increase to $120 per barrel after 2020. EIA’s Annual Energy Outlook 2016 reference case prices remain below $100 per barrel through 2030. (See chart below.)

Source: http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

State Impacts

The table below show the impacts of banning hydraulic fracturing on the cost of living in four states—Texas, Pennsylvania, Ohio, and Colorado. Texas is the most impacted since it ranks number one in oil and gas production. Under a ban on hydraulic fracturing, Texas loses 1.49 million jobs, Pennsylvania loses 466,000 jobs, Ohio loses 397,000 jobs and Colorado loses 215,000 jobs. The cost of living for the average family increases almost $3,500 per year in Colorado and Pennsylvania, almost $4,000 per year in Ohio and over $4,600 per year in Texas.

Source: http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

Conclusion

Replacing 52 percent of our oil and almost 70 percent of our natural gas if a ban is placed on hydraulic fracturing would return oil and natural gas prices to levels prior to the energy renaissance experienced since 2008 and then to levels even higher. The United States would become an LNG importer, rather than exporter and tight oil markets would end up the norm again. That would mean that the gains we have made to energy independence would be gone and oil and gas markets would become volatile again. This is not a pretty picture.

[i] CBS, Monterey County Voters Approve Ban On Oil Drilling, Fracking, November 9, 2016, http://sanfrancisco.cbslocal.com/2016/11/09/monterey-county-voters-approve-oil-drilling-fracking-ban/

[ii] U.S. Chamber of Commerce, What If Hydraulic Fracturing Was Banned?, November 2016, http://www.energyxxi.org/sites/default/themes/bricktheme/pdfs/CoC_BannedFracking_FULL_v3.pdf

The post What Would a Ban on Hydraulic Fracturing Mean? appeared first on IER.

No comments:

Post a Comment