Europe and the United States need to prepare for lower gasoline and diesel tax revenues if electric vehicle sales skyrocket as some analysts predict. For example, if electric vehicles were to represent 60 percent of U.S. new car sales by 2030, annual tax revenue (federal and state) would be reduced by $10 billion, or about 14 percent compared to if electric vehicle sales remained flat at 1 percent of new car sales. If electric vehicle sales reached 20 percent of new car sales, gasoline revenue would still fall by $3 billion, or about 5 percent.[i] California, which has the highest number of electric vehicles, would be hit hard as it currently has the sixth largest gasoline tax.[ii] The state recently passed an increase to its gasoline tax of $0.12 per gallon (up to $0.52 a gallon from $0.40 per gallon) and an increase in its diesel tax by $0.20 per gallon, both of which will take effect on November 1.[iii] The increase will make its gasoline tax the second highest in the country, behind only Pennsylvania.

A sizable number of electric vehicles is needed to significantly reduce oil consumption. To reduce oil consumption by one million barrels per day, it would take approximately 36.5 million electric vehicles, assuming that an average car drives about 10,000 miles per year with an estimated efficiency of 25 miles per gallon. That means an average car uses about 400 gallons of gasoline, or about 10 barrels of oil per year. Since one million barrels per day of oil is equal to about 365 million barrels of oil per year, it would take about 36.5 million cars to consume 365 million barrels per year. Note that this example does not include the energy that electric vehicles consume, which is largely produced by fossil fuels.[iv] Fossil fuels generate about 65 percent of our electricity.[v]

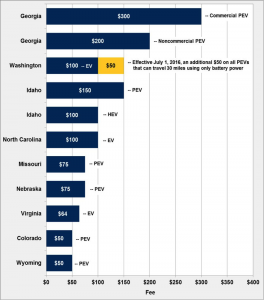

Fees on Electric Vehicles

Gasoline and diesel taxes are supposed to provide revenue for road construction, maintenance, repair, and improvements, but states typically divert much of these funds to other projects. To thwart the decline in gasoline tax revenues, some states have enacted fees on electric vehicles. As of early July 2017, 17 states enacted an additional registration fee on electric and hybrid vehicles, ranging from $50 to $200 annually. Seven states (West Virginia, Michigan, Minnesota, Indiana, Oklahoma, Tennessee and California) enacted policies setting these annual fees this year. South Carolina enacted a biennial fee for electric cars. The following nine states passed or implemented electric vehicle fees in previous years: Georgia, Washington, Wyoming, Idaho, Colorado, Missouri, Nebraska, North Carolina and Virginia.[vi]

Annual State Fees for EV Owners as of September 2015

Source: Office of Energy Efficiency and Renewable Energy

Note: EV = All Electric Vehicle; PHEV = Plug-in Hybrid Electric Vehicle; PEV = Plug-in Electric Vehicle (includes both EV and PHEV); HEV = Hybrid Electric Vehicle (no plug).

Gasoline Taxes Higher in Europe

Gasoline prices in Europe range between $5.00 and $7.50 per gallon[vii]—about two to three times more than gasoline prices in the United States. The primary reason for the disparity in prices is the higher taxes in European countries. According to data from the Organization of Economic Cooperation and Development (OECD), the average gas excise tax rate among the 34 advanced economies is $2.62 per gallon with the U.S. gas tax the second lowest (Mexico does not have a gas tax). On top of these excise taxes, most OECD countries also levy their value added tax (VAT) on gasoline consumption, making the total tax differential on gasoline even higher. The gasoline tax in Europe is used for multiple purposes and not just for road maintenance and infrastructure construction.[viii] Thus, the revenues that Europe loses from banning internal combustion vehicles will be sizable and will need to be replaced by other mechanisms of taxation.[ix]

Conclusion

The lost gasoline tax revenues from electric vehicle penetration can be enormous if sales skyrocket. While that certainly would have an impact on gasoline tax revenues in the United States, the impact would be even larger in Europe where gasoline and diesel taxes are much higher and incentives to purchase electric vehicles are also high.

[i] Axios, In Focus: electric vehicles, August 16, 2017, https://www.axios.com/generate-2473288699.html

[ii] American Petroleum Institute, http://www.api.org/~/media/Files/Statistics/StateMotorFuel-OnePagers-July-2017.pdf

[iii] Daily Caller, Report: Growing Electric Vehicle Ownership Craters Gas Tax Revenues, August 16, 2017, http://dailycaller.com/2017/08/16/report-growing-electric-vehicle-ownership-craters-gas-tax-revenues/

[iv] Seeking Alpha, How Many Electric Vehicles Would It Take To Replace 1 Mbd Of Oil Demand?, July 10, 2017, https://seekingalpha.com/article/4086585-many-electric-vehicles-take-replace-1-mbd-oil-demand?auth_param=1cqlaa:1cm6rt8:263e414d4408ecbf68362d591e5c4720&dr=1

[v] Energy Information Administration, Monthly Energy Review, https://www.eia.gov/totalenergy/data/monthly/pdf/sec7_5.pdf

[vi] Green Tech Media, Updated: 17 States Now Charge Fees for Electric Vehicles, July 5, 2017, https://www.greentechmedia.com/articles/read/13-states-now-charge-fees-for-electric-vehicles

[vii] Global Petrol Prices, Gasoline Prices, August 14, 2017, http://www.globalpetrolprices.com/gasoline_prices/

[viii] Tax Foundation, How High are Other Nations’ Gas Taxes?, March 3, 2015, https://taxfoundation.org/how-high-are-other-nations-gas-taxes/

[ix] Institute for Energy Research, Will Consumers Forfeit Traditional Vehicles for Electrics?, August 10, 2017, http://instituteforenergyresearch.org/analysis/will-consumers-forfeit-traditional-vehicles-electrics/

The post Gas Tax Revenues Will Plummet With Large Increase in Electric Vehicles appeared first on IER.

No comments:

Post a Comment