In a previous article, I explained that the federal gasoline tax was a very crude way to fund highways, because there is only a tenuous link between gasoline consumption and highway usage. I followed up with an article explaining that once you add in state and local taxes on gasoline, you’re already talking over 20 percent of the price of a gallon at the pump, and furthermore the proposed hike of 25 cents per gallon would push the tax on gasoline above the limit appropriate for the “social cost of carbon” as estimated by the EPA.

In the present article, I’ll focus on yet another problem with the conventional narrative: Taxes on gasoline (at all levels), as of 2010, only covered 43 percent of total spending on state and local roads. Governments at all levels are already covering road construction and maintenance costs with tolls and other forms of tax.

To tell Americans that we need to raise the federal gas tax in order to make “road users” pay for roads is utterly misleading. They are already being taxed nine ways to Sunday for roads. A federal gas tax hike is just tightening the screws on people who are still struggling from the ravages of the last recession.

Gas Taxes Don’t Cover Road Spending

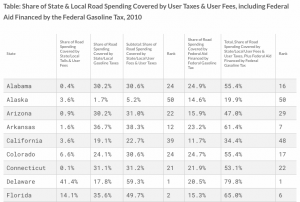

The best data I could find come from a 2013 Tax Foundation report (using 2010 numbers). Here is an excerpt from a table compiled by the author, Joseph Bishop-Henchman, that gives the breakdown from a few states:

The table excerpt shows how misleading the popular narrative is, concerning gas taxes and road usage. Take the case of California. State and local gasoline taxes covered 19.1 percent of total road spending, while the aid provided from the federal government (out of the 18.4 cents per gallon federal gas tax) covered an additional 11.7 percent, for a total of 30.8 percent covered by gas taxes. In addition, explicit tolls and other direct user fees covered 3.6 percent of California’s road spending. All told, only 34.4 percent of the state’s total road spending in 2010 was covered by gas taxes and direct user fees. The remaining 65.6 percent was covered out of more general revenues.

Conclusion

In addition to expecting better management under private ownership, the benefit of privatizing the roads is that governments at all levels wouldn’t be able to justify tax hikes by claiming “we need to fix the roads.” They are already taxing and charging Americans in numerous ways, and they still do a crummy job filling potholes.

The post The Gas Tax Has Little to Do With Road Costs appeared first on IER.

No comments:

Post a Comment