WASHINGTON, D.C. — Today the Institute for Energy Research released a study that delivers a sobering economic analysis of six carbon tax scenarios, including one that mirrors the tax-and-rebate scheme proposed by the Climate Leadership Council.

The analysis, commissioned by IER and conducted by Capital Alpha Partners, LLC, uses standard scoring conventions (similar to those used by JCT, CBO and Treasury) to evaluate and model the economic impacts of carbon taxes set at a variety of dollar figures, with different phase-in durations, and with an array of revenue-recycling strategies.

The key findings include:

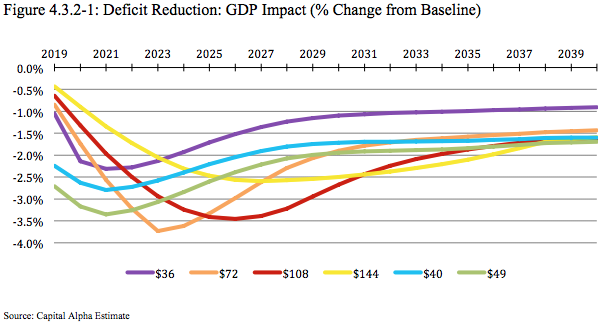

- A carbon tax will not be pro-growth. Most carbon tax scenarios reduce GDP for the entirety of the 22-year forecast period. Better than break-even economic performance may not be possible unless revenue is devoted entirely to corporate tax relief. A lump-sum rebate results in lost GDP equal to between $3.76 trillion and $5.92 trillion over the 22-year forecast period.

- A carbon tax is not an efficient revenue raiser for tax reform. Using standard scoring conventions, a carbon tax is likely to only produce net revenue available for tax reform of 32 cents on the dollar.

- No carbon tax modeled is consistent with meeting the long-term U.S. Paris Agreement INDC. As a standalone policy, consistent with World Bank and IEA estimates, all carbon tax scenarios analyzed are far off of the trajectory the Paris Agreement sets for 2040, undermining claims that a tax-for-regulation swap will satisfy emissions commitments.

- Depressed GDP leads to long-term fiscal challenges, with particular stress on states. Persistent reductions in economic performance lead to trillions of dollars in lost GDP, thereby reducing state tax revenues and straining state budgets. The average annual burden on the states and local government during the first 10 years of the tax would range from $18.9 to $30.6 billion.

Institute for Energy Research President Thomas J. Pyle made the following statement:

“The release of this analysis comes at an important time as numerous carbon tax proposals arise in Washington and are being considered for introduction in Congress. This study shows that when carbon tax scenarios are subject to the same scrutiny as an actual legislative proposal, it is all pain and no gain for the overall economy, with the states, in particular, being significantly impacted.

“Despite claims from carbon tax advocates, this analysis shows that a carbon tax will not improve our environment or U.S. fiscal stability in any meaningful way. In other words, carbon taxes are bad fiscal and environmental policy. Any member of Congress that lends their name to proposals like the one put forth by the Climate Leadership Council would essentially be taxing American families and small businesses, undermining our economic recovery, negatively impacting state governments, and increasing government spending, all while doing virtually nothing to improve the environment.”

The full study can be viewed here.

For the key takeaways, click here.

For further analysis from Senior Economist at IER, Robert Murphy, click here.

###

For media inquiries, please contact Erin Amsberry

eamsberry@ierdc.org

The post RELEASE: New Analysis Reveals High Costs, Low Reward on Carbon Tax Proposals appeared first on IER.

No comments:

Post a Comment