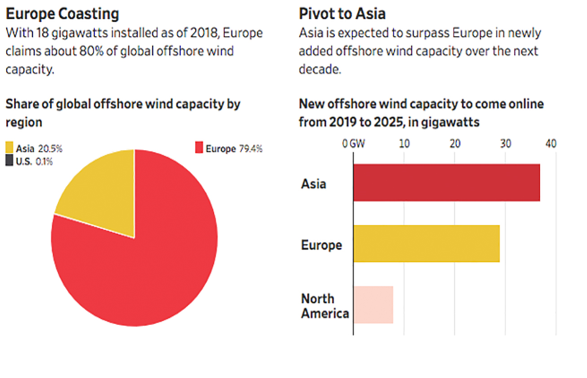

The global offshore wind industry is still very small with just 23 gigawatts worldwide—80 percent in Europe and 20 percent in Asia. Despite the majority of offshore wind units (18 gigawatts) being located in Europe currently, the Asia-Pacific region expects to add 37 gigawatts of offshore wind capacity through 2025—a faster growth rate than in Europe. Most of the Asian development is occurring in China, Taiwan, Japan, and South Korea. China added 1.8 gigawatts of offshore wind capacity and approved an additional 13.1 gigawatts in 2018. The Taiwanese government plans to have 5.7 gigawatts of offshore wind power by 2025 and an additional 5 gigawatts by 2030.

China

China increased it offshore wind capacity by 60 percent in 2018. The country commissioned its largest project that year—a 400-megawatt farm in Jiangsu province, which is becoming China’s most prominent province for offshore wind power. Jiangsu province’s location just north of Shanghai positions it well for increasing demand in Shanghai.

In 2018, China approved 13.1 gigawatts of new offshore wind capacity across 12 projects. These projects receive a feed-in-tariff of $0.11 to $0.13 per kilowatt-hour, depending on their location. (Industrial electricity rates average $0.084 per kilowatt-hour). In the future, China plans on using an auction system for offshore wind projects.

Taiwan

Taiwan instituted a feed-in-tariff in 2017, offering $0.19 per kilowatt-hour for 20 years, or $0.23 per kilowatt-hour for the first 10 years for offshore wind operation, attracting a proposed pipeline of 10.5 gigawatts.

Taiwan’s first offshore wind farm, Formosa 1, began commercial operation with two 4-megawatt wind turbines in April 2017. The second phase of Formosa 1, which is expected to be fully operational this year, consists of twenty 6-megawatt offshore wind turbines. The project’s total capacity is 128 megawatts. Formosa 1 is located approximately two to six kilometers (one to four miles) off of Taiwan’s coast. Because natural disasters such as typhoons and earthquakes are a risk for offshore wind in the region, Formosa 1 was designed to withstand waves of up to 45 feet.

Last month, a ground-breaking ceremony was held for Formosa 2, which will consist of 47 eight-megawatt offshore wind turbines for a total capacity of 376 megawatts. The project, located near Formosa 1, is expected to cost approximately $2.05 billion. Construction is planned to begin in 2020, and production in 2021.

Taiwan’s Formosa 3, expected to be completed between 2026 and 2030, will have an estimated capacity five times that of Formosa 2, and 15 times that of Formosa 1. It will add two gigawatts of offshore wind capacity, making it three times the size of the largest offshore wind farm currently in operation off the coast of England.

South Korea

South Korea plans to add 48.7 gigawatts of renewable energy, with 12 gigawatts from offshore wind. However, except for a 30-megawatt offshore wind farm commissioned in 2017 and other single-turbine demonstrations, there was little activity in 2018. Only one 60-megawatt project has started construction—the first phase of the Southwest Offshore project. When the second and third phases are included, this project is expected to total 2.5 gigawatts.

Japan

Japan would like to add 10 gigawatts of offshore wind by 2030, but faces technical challenges in its offshore water depths, generally over 50 meters (164 feet), and natural conditions such as typhoons and earthquakes. Also, getting the necessary environmental approvals is normally a lengthy process, and there are grid constraints in the country. In late 2018, Japan passed the Marine Renewables Energy Bill that is expected to increase offshore wind activities. It sets up an auction process for offshore wind projects and grants developers a 30-year usage of approved wind development zones. Japan also researched floating offshore wind farms, and in 2018 commissioned a test project of 3 megawatts. This test and the Fukushima pilot floating offshore wind project may allow for other large-scale floating wind farms.

Vietnam and Southeast Asia

Except for Vietnam, no country in Southeast Asia has any significant offshore wind pipelines. In the middle of 2018, Vietnam increased the feed-in-tariff price for offshore wind projects to $0.098 per kilowatt-hour for projects commissioned by the end of 2021. In 2018, three projects totaling 272 megawatts started construction. The largest offshore wind project planned is a 3.4-gigawatt project with the first phase (600 megawatts) to be completed after 2022.

India

India has plans to add 5 gigawatts of offshore wind power by 2030, but currently has no offshore wind capacity installed. In April 2018, the National Institute of Wind Energy opened a tender to develop a one-gigawatt project, attracting 35 developers. India has also been finalizing its rules for offshore sites leasing in support of this development.

Conclusion

Currently, Europe has the most offshore wind capacity followed by Asia. But, going forward, Asia is expected to add offshore capacity at a faster rate than Europe, with China and Taiwan leading the development. Feed-in-tariffs or other incentives are being offered to meet the country’s goals since offshore wind projects are expensive and countries such as Taiwan and Japan are in areas where natural disasters such as typhoons and earthquakes occur forcing the projects to be able to withstand waves of substantial height.

The post Asia Expected to Surpass Europe in New Offshore Wind Additions appeared first on IER.

No comments:

Post a Comment