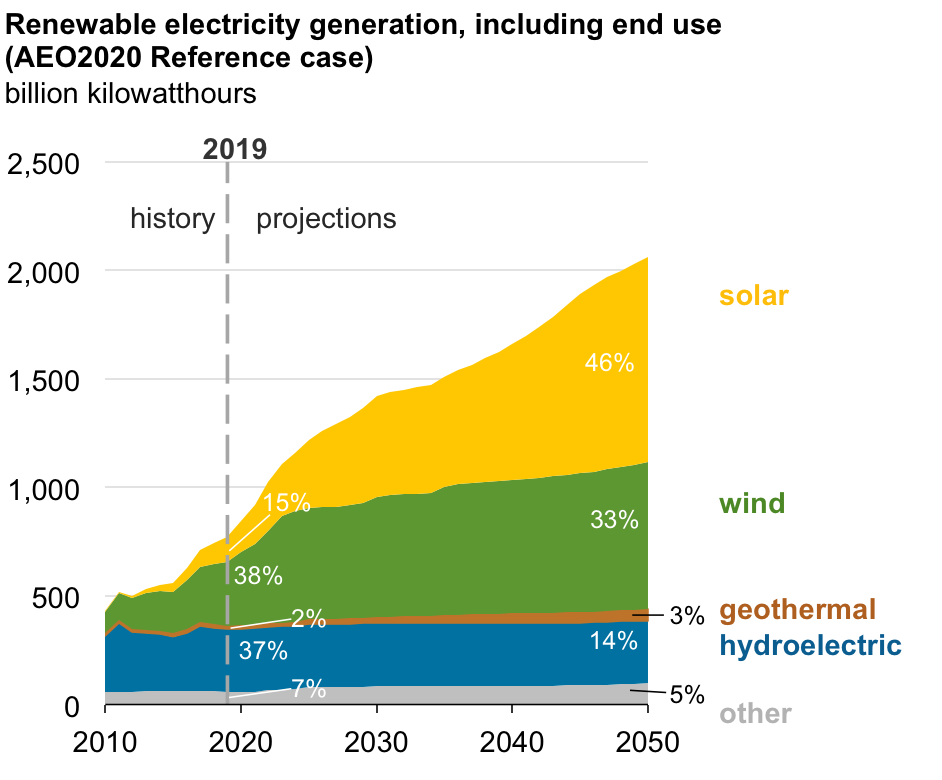

The Energy Information Administration (EIA) continues its optimistic outlook on the cost of wind and solar power, resulting in renewable energy being the fastest-growing source of electricity generation through 2050 in its newly released Annual Energy Outlook. The agency believes that the capital costs for solar and wind will continue to decline and that federal and state subsidies along with state mandates for renewables will continue to enable their penetration into the generating sector. As a result, it expects coal-fired and nuclear electricity generation to decline with most of those declines occurring by the mid-2020s.

Despite this projected increase in renewable energy and the subsidies and mandates that enable its penetration into U.S. energy markets, its share of total energy demand increases from 11 percent today to just 18 percent in 2050—a period of three decades. EIA projects that the fossil fuel share of total energy demand in 2050 to be 75 percent—a decline of just 5 percentage points from 2019.

Oil

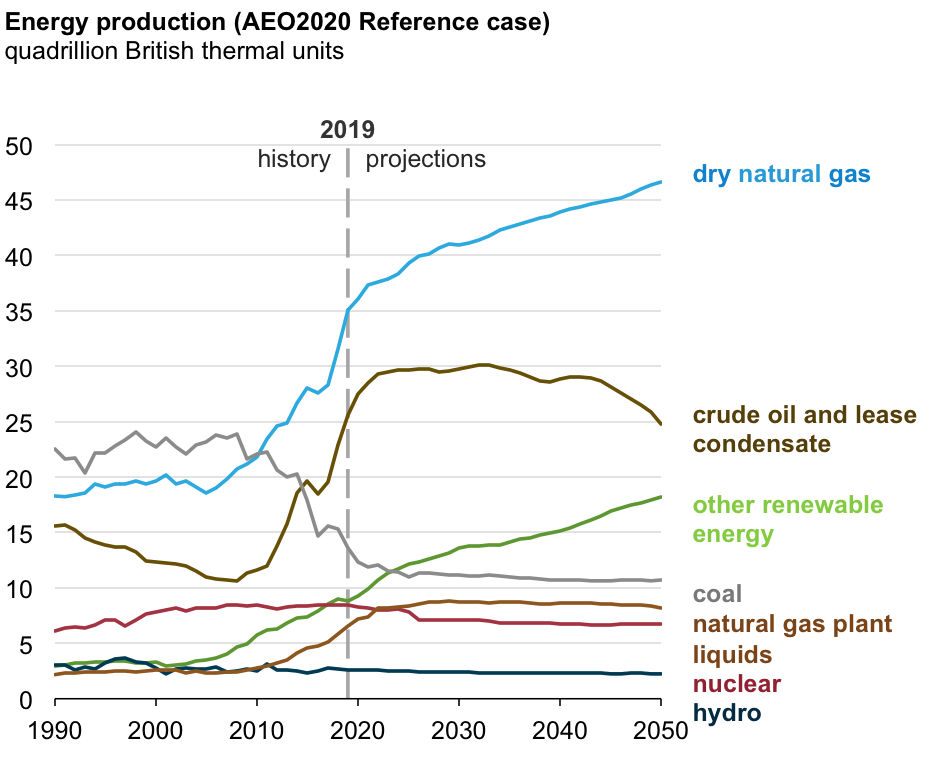

The United States continues to produce historically high levels of crude oil and natural gas and continues to increase exports of crude oil, petroleum products, and liquefied natural gas. EIA expects crude oil production to increase to 14 million barrels per day by 2022—an increase of nearly 7.6 million barrels per day in a decade—but to then level off, increasing by less than 400,000 barrels per day over the next decade as the agency expects operators to move to less productive plays and well productivity to decline. Oil production is expected to begin a slow decline in the mid-2030s, falling another 500,000 barrels per day over the next decade and declining below 12 million barrels per day by 2050.

Onshore tight oil development in the Lower 48 continues to be the main driver of crude oil production, accounting for about 70 percent of cumulative domestic production in the forecast. Production in the Lower 48 is expected to peak at 13.84 million barrels per day in 2032, accounting for 96 percent of total production that year.

Deepwater discoveries of oil and natural gas resources in the Gulf of Mexico is expected to lead offshore production in the Lower 48, reaching a record 2.4 million barrels per day in 2026. Many of these discoveries occurred during exploration that took place before 2015, when oil prices were higher than $100 per barrel, and they are being developed as oil prices increase in the forecast. Offshore production increases through 2035 before generally declining through 2050 as a result of new discoveries only partially offsetting declines in legacy fields.

Alaska crude oil production is expected to increase through 2041, driven primarily by the development of fields in the National Petroleum Reserve–Alaska before 2030, and by the development of fields in the 1002 Section of the Arctic National Wildlife Refuge after 2030. Oil production in Alaska is expected to increase from 480,000 barrels per day in 2019 to a peak of 910,000 barrels per day in 2041.

Natural Gas Plant Liquids

The continued development of tight oil and shale gas resources supports growth in natural gas plant liquids (NGPL) production, which reaches 6.6 million barrels per day by 2028. Natural gas plant liquids are light hydrocarbons predominantly found in natural gas wells and are diverted from the natural gas stream by natural gas processing plants. These hydrocarbons include ethane, propane, normal butane, isobutane, and natural gasoline. EIA expects production to grow by 26 percent during the projection period as a result of demand increases by the global petrochemical industry. Most NGPL production growth is projected to occur before 2025 as producers focus on natural gas plant liquids-rich plays, where NGPL-to-gas ratios are highest and increased demand spurs greater ethane recovery.

Natural Gas

EIA expects natural gas dry production to grow 1.9 percent per year from 2020 to 2025, which is slower than the 5.1 percent-per-year average growth rate from 2015 to 2020. Natural gas production grows at a faster rate than consumption after 2020, leading to an increase in U.S. exports of natural gas. Natural gas consumption is expected to remain relatively flat through 2030 because of slower industrial sector growth and a decline in electric power consumption. After 2030, consumption growth is expected to increase almost 1 percent per year as natural gas use in the electric power and industrial sectors is expected to increase.

To satisfy the growing demand for natural gas, U.S. natural gas production expands into less prolific and more expensive-to-produce areas, putting upward pressure on production costs. Natural gas prices are expected to remain lower than $4 per million British thermal units through 2050 because of an abundance of lower-cost resources, primarily in tight oil plays in the Permian Basin. These lower-cost resources allow higher production levels at lower prices during the projection period.

EIA expects natural gas production from shale gas and tight oil plays to continue to grow, both as a share of total U.S. natural gas production and in absolute volume. This growth is a result of the size of the associated resources, which extend over nearly 500,000 square miles, and improvements in technology that allow the development of these resources at lower costs. Onshore production of natural gas from sources other than tight oil and shale gas, such as coalbed methane, is generally expected to continue to decline through 2050 because of unfavorable economic conditions for producing these resources. Offshore natural gas production remains relatively flat during the projection period, driven by production from new discoveries that generally offset declines in legacy fields.

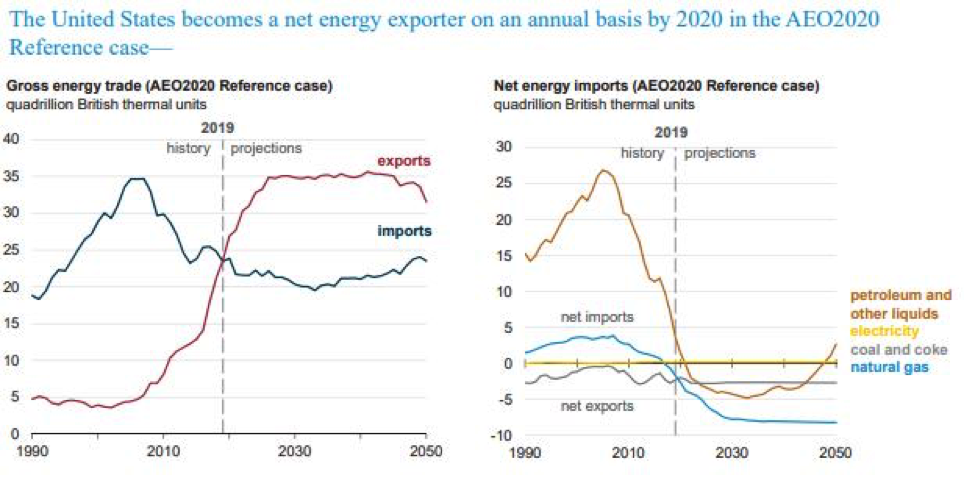

Exports

Since 1953, the United States has imported more energy than it exported annually, but the United States is expected to export more petroleum and other liquids than it imports annually beginning in 2020 as U.S. crude oil production continues to increase and domestic consumption of petroleum products decreases. Near the end of the projection period, the United States returns to importing more petroleum and other liquids than it exports on an energy basis as a result of increasing domestic gasoline consumption and falling domestic crude oil production after 2047.

Exports of diesel and residual fuel (especially low-sulfur residual fuel) increase to 2.5 million barrels per day in 2020 because U.S. refineries are well-positioned to supply some of the increase in global demand for low-sulfur fuels as a result of the International Maritime Organization’s new limits on sulfur content in marine fuels.

The United States became a net natural gas exporter on an annual basis in 2017 and continued to export more natural gas than it imported in 2018 and in 2019. EIA expects liquefied natural gas (LNG) exports to more distant destinations to increasingly dominate the U.S. natural gas trade, and the agency expects the United States to remain a net natural gas exporter through 2050.

The United States continues to be a net exporter of coal (including coal coke) through 2050, but coal exports remain at the same level because of competition from other global suppliers that are closer to major world consumers.

Electricity

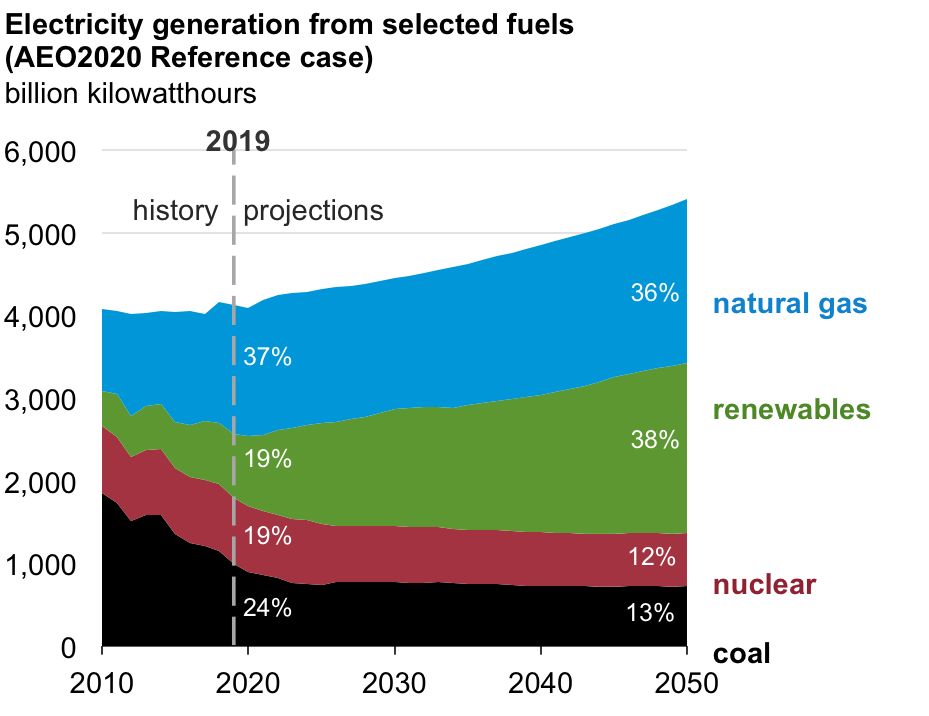

EIA expects the annual growth in electricity demand to average about 1 percent throughout the projection period (2019-2050). Historically, growth rates for electricity demand have slowed as new, efficient devices and production processes that require less electricity have replaced older, less-efficient appliances, heating, ventilation, cooling units, and capital equipment. The growth in projected central-station electricity sales would be higher except for growth in generation from rooftop photovoltaic systems, primarily on residential and commercial buildings, and combined-heat-and-power systems in industrial and some commercial applications. By 2050, end-use solar photovoltaic is projected to account for 4 percent of total generation.

Because of declining capital costs and higher renewable portfolio standards in some states, EIA projects the growth in renewables seen during the past 10 years will continue through the projection period, growing faster than overall electricity demand in the forecast. EIA expects renewable generation to exceed natural gas-fired generation after 2045. Coal-fired and nuclear generation are expected to decline through the mid-2020s as a result of retirements, then generation from these sources is expected to stabilize over the longer term as the more economically viable plants remain in service. EIA sees natural gas-fired generation as the marginal fuel source to fulfill incremental electricity demand. In 2050, EIA is forecasting that renewable energy will supply 38 percent of U.S. electrical generation, natural gas 36 percent, coal 13 percent, and nuclear 12 percent.

EIA assumes that coal-fired plants must either invest in heat rate improvement technologies that improve the efficiency of power plants by 2025 or retire to comply with the Affordable Clean Energy rule. The remaining coal plants are more efficient and continue to operate throughout the projection period. Low natural gas prices in the early years of the forecast are also expected to contribute to the retirements of coal-fired and nuclear plants because EIA assumes that coal and nuclear generators are less profitable in these years.

EIA expects the United States to build 117 gigawatts of new wind and solar capacity between 2020 and 2023, which is the result of tax credits, increasing state renewable portfolio standards, and declining capital costs. New wind capacity additions are expected to continue at much lower levels after production tax credits expire in the early 2020s, but the growth in solar capacity continues through 2050 for both the utility-scale and small-scale applications because EIA assumes that the cost of solar PV will decline throughout the projection period.

Carbon Dioxide Emissions

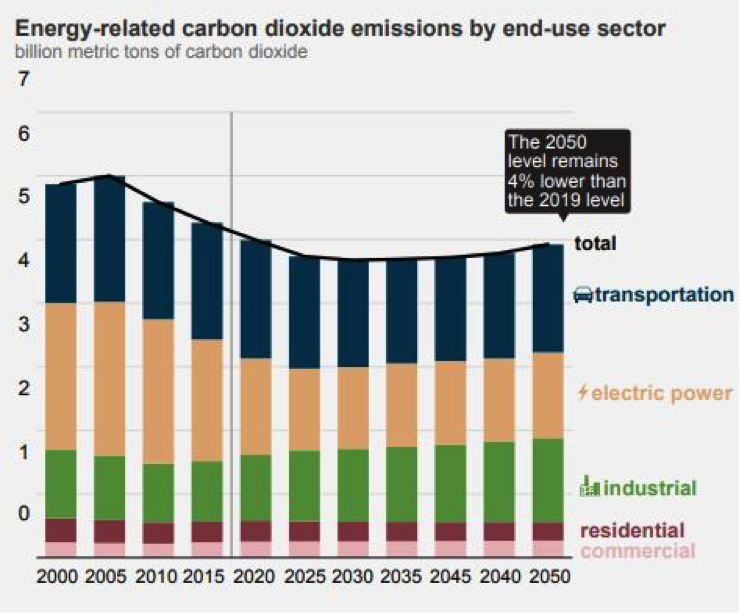

U.S. energy-related carbon dioxide emissions in 2050 are projected to be 4 percent lower than in 2019. EIA expects them to fall during the first half of the projection period and then increase modestly in the 2030s due largely to increases in energy demand in the transportation and industrial sectors.

Conclusion

Federal subsidies, state subsidies, and state mandates enable the combined generation of solar, wind, hydroelectric, and geothermal to overtake natural gas in the generating sector by 2050 in EIA’s latest forecast. Despite those gains in the electricity sector, EIA forecasting that renewable energy will provide only 18 percent of U.S. total energy demand in 2050; fossil fuels are still expected to provide most of the nation’s energy—75 percent. The forecast also shows carbon dioxide emissions are expected to be 4 percent lower than they were in 2019 and that the United States will be a net exporter of energy for at least the next three decades.

The post EIA Releases Its Annual Energy Outlook 2020 appeared first on IER.

No comments:

Post a Comment