BP predicts that global oil demand will peak in 2042 due to the penetration of electric vehicles, the slowing economic growth in China and global actions taken to reduce greenhouse gas emissions. But not all forecasters agree. The International Energy Agency expects oil demand to continue to increase through the end of its modeling horizon—2040. Saudi Arabia and Russia, the world’s largest oil exporters, believe it will continue to grow until at least 2050.[i] The expectation that oil demand will peak is the opposite of what was once expected. Some forecasters had expected oil supply to peak, but technological advances (e.g. hydraulic fracturing) have changed that thinking.

BP’s Energy Outlook forecasts global supply and demand through 2035. Some of the major themes in its 2017 forecast are[ii]:

- China’s energy demand growth slows to 1.9 percent per year by 2035—less than one-third its rate in the past 20 years (6.3 percent per year). Its GDP growth averages about 5 percent per year, around half the average pace of growth since 2000. China gradually shifts away from energy-intensive industrial output toward more energy-light consumer and services activity.

- India’s energy consumption grows the fastest among the world’s economies.

- Emerging Asia’s energy consumption increases by 62 percent by 2035, with coal contributing the largest increment of growth.

- The global car fleet doubles due to rising prosperity, which boosts car ownership, especially in emerging markets. Fuel efficiency goals and lower battery costs spur electrification. The number of electric cars increases from 1.2 million in 2015 to about 100 million by 2035 (6 percent of the global fleet).

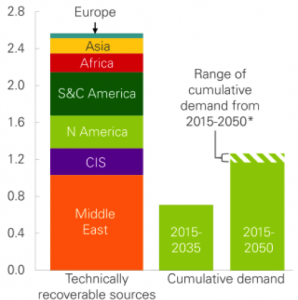

- There is an abundance of oil supply, which contrasts with slow growing oil demand. Cumulative oil demand to 2035 is expected to be around 700 billion barrels—significantly less than recoverable oil in the Middle East alone.

Oil Abundance

Global proved oil reserves have more than doubled over the past 35 years. For every barrel of oil consumed, over two new barrels have been discovered.

Technically recoverable oil is estimated to be about 2.6 trillion barrels. Technically recoverable oil is a measure of those oil resources that could be extracted using today’s technology. Around 1.7 trillion barrels (65 percent) of those resources are located in the Middle East, the Commonwealth of Independent States (CIS) and North America.

Due to supply abundance and slowly growing demand, low cost oil producers are expected to benefit and increase their market share. BP assumes that production from Middle East OPEC, Russia and the United States increases disproportionately over the forecast period, with its share growing from 56 percent today to 63 percent in 2035.

Through 2050, cumulative global oil demand amounts to less than half of today’s technically recoverable oil resources.

Other Fuels

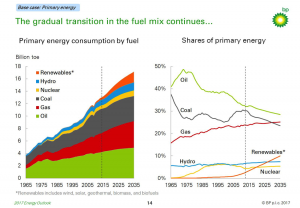

BP expects energy consumption to increase by 30 percent with a mix of fuels that becomes progressively lower in carbon. Energy consumption is expected to grow at 1.3 percent per year from 2015 to 2035 compared to 2.2 percent per year growth in the 1995 to 2015 period. Virtually all the growth in world demand comes from fast-growing emerging economies, with China and India accounting for over half of the increase.

The gradual decarbonization of the fuel mix is expected to continue, with renewable energy, together with nuclear and hydroelectric power, expected to account for half of the growth in energy supplies. Even so, oil, natural gas and coal remain the dominant sources of energy, accounting for over 75 percent of energy supplies in 2035.

Almost two-thirds of the increase in global energy consumption is used for electricity generation. The share of energy used for power generation increases from 42 percent to 47 percent in 2035.

Natural gas is expected to grow faster than oil or coal, with consumption increasing by 1.6 percent per year between 2015 and 2035. Shale production is expected to grow at 5.2 percent per year and accounts for about 60 percent of the increase in natural gas supplies. In the United States, shale output more than doubles. Closer to 2035, China becomes the second largest shale supplier. China and Europe become more dependent on imported gas over the forecast period and a rapid expansion of liquefied natural gas (LNG) helps to support gas consumption.

Growth in global coal demand is expected to slow sharply, increasing at just 0.2 percent per year compared to 2.7 percent per year over the past 20 years. China remains the world’s largest market for coal, accounting for nearly half of global coal consumption in 2035. India is the largest growth market, with its share of world coal demand doubling from about 10 percent in 2015 to 20 percent in 2035.

Nuclear power is expected to increase by 2.3 percent per year through 2035 and hydroelectric power is expected to increase 1.8 percent per year–roughly maintaining their combined share within the power sector. China accounts for almost three-quarters of the increase in nuclear generation–roughly equivalent to introducing a new reactor every three months for the next 20 years.

Non-hydroelectric renewable energy in the power generation sector is expected to be the fastest-growing source of energy, increasing at 7.6 percent per year to 2035. Non-hydroelectric renewable energy accounts for 40 percent of the growth in power generation, resulting in its share of global power generation increasing from 7 percent in 2015 to almost 20 percent by 2035.

Conclusion

BP expects oil, coal and natural gas to provide 75 percent of the world’s energy in 2035 despite the growth in non-carbon energy sources. Nuclear and hydroelectric power increase but just enough to keep their combined share in the electricity market. Non-hydroelectric renewable energy increases the fastest of all fuels, garnering a global electricity market share of almost 20 percent in 2035. As a result, carbon dioxide emissions are projected to grow at less than a third of the rate of the past 20 years—0.6 percent per year compared to 2.1 percent. However, that means that they are still projected to be 13 percent higher in 2035 than today.

[i] Bloomberg, Remember Peak Oil? Demand May Top Out Before Supply Does, July 11, 2017, https://www.bloomberg.com/news/articles/2017-07-11/remember-peak-oil-demand-may-top-out-before-supply-does

[ii] BP Energy Outlook 2017 Edition, https://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2017/bp-energy-outlook-2017.pdf

The post BP Predicts Global Oil Demand Will Peak in 2042 appeared first on IER.

No comments:

Post a Comment