In a recent series of posts (here and here), I amplified some of Oren Cass’s strongest criticisms of the typical case for a US carbon tax. Seeing an opportunity for a zinger, Josiah Neeley at R Street put up a post entitled, “Prominent carbon tax skeptic admits it could increase economic growth.” Although I appreciate being dubbed “prominent,” as we’ll see the R Street post is wrong in both title and in substance. Neeley is referring to my discussion of a capital tax cut offsetting the damage of a carbon tax, but that of course is far from saying a carbon tax could increase economic growth. Beyond that, Neeley’s advice to me to advocate politically impossible outcomes is also dubious.

The Carbon Tax and Economic Growth

Though it may surprise you in light of the campaign being waged by a few vocal writers, the standard modeling results show that a carbon tax would be profoundly harmful for measured economic growth. Now to be clear, these standard models from the literature assume that greenhouse gas emissions on net pose a negative externality (at least after a certain point which they project humanity has already surpassed), and so they would conclude that some carbon tax would be justified for environmental reasons, even though it would reduce conventionally measured GDP growth and would feel burdensome to consumers in the form of higher electricity and gas prices.

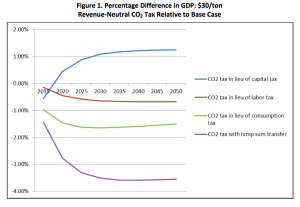

To get a sense of just how onerous a carbon tax would be, I can refer you to the following diagram, taken from a 2013 Resources for the Future (RFF) study that was pro-carbon tax.

As the chart indicates, the RFF study—which is quite orthodox in this literature—concluded that even a 100% revenue-neutral carbon tax would reduce measured economic output if the carbon tax receipts were refunded back to citizens in any of these three ways: tax cuts on workers (red line), tax cuts on consumption (green line), or lump-sum dividend check mailed back to citizens (purple line).

This result should be shocking to someone who listened to the promises made by people advocating a “double dividend” or “win-win” outcome, claiming that by “taxing bads, not goods” a carbon tax that was wisely designed could reduce climate change and spur conventional economic growth.

Looking again at the chart, notice that the one type of revenue-neutral tax swap that would deliver that promised result, would be a cut on capital taxes (the blue line).

Now in this context, I pointed out in my previous article that the people pushing a carbon tax to conservatives and libertarians were being very misleading if they promised a “win-win” from “tax reform.” Because clearly—as both Oren Cass and I have been pointing out—no politically feasible carbon tax is going to make energy more expensive for poor people, in order to funnel trillions of dollars in tax cuts to corporate shareholders. Yet that’s what the RFF chart is showing would have to happen.

(In fairness to Neeley, he is right when he says that a combination of large tax cuts on capital and some other categories of tax cut might still yield positive economic growth. Even so, the magnitudes of the lines in the chart above show that huge amounts of carbon tax receipts would need to be used to cut taxes on capital in order to even hope for economic growth in principle.)

Neeley Wrong to Claim Carbon Tax “Could Increase Economic Growth”

To reiterate, Neeley’s post in the very title says that I admitted a carbon tax “could increase economic growth.”

I did no such thing. Rather, what I did was point to the RFF study which said a carbon tax would significantly hurt economic growth, but not as much as a tax on capital does. That’s why implementing a carbon tax while using all of the revenues to reduce capital taxes, could theoretically increase economic growth in the RFF model.

This isn’t mere semantic quibbling. Suppose some mobsters go around killing people who owe them money on their gambling debts, and I point out to them, “Excuse me, fellas, if you just broke their legs with a baseball bat, more of them would be able to pay you off.” In this scenario, did I just admit that breaking people’s legs makes them more productive? Of course not. I was merely pointing out that breaking their legs hurt their productivity less than killing them outright.

Likewise, the RFF chart isn’t showing that imposing a new carbon tax helps the conventional economy. Rather, it’s showing that it hurts the economy, but that if the revenue were devoted exclusively to cutting taxes on capital, on net the economy could be helped. This isn’t because the carbon tax is good for growth, it’s because taxes on capital are even more destructive than the destructive carbon tax.

Taxes on Capital Are Very Harmful

People have been lectured for so many years on the alleged virtues of a carbon tax, that it’s easy to forget just how destructive it is. Think about it: It is a tax concentrated on a fairly narrow segment of the economy, which also happens to be associated with energy production and transportation. In general, the tax literature says that you minimize the “deadweight loss” from taxation by picking as broad a base as possible, in order to levy the lowest rate possible, for a desired amount of revenue. Considered strictly as a means of raising revenue, a carbon tax is a very poor tool. If advocates want to stress the environmental virtues, fair enough, but here I’m pushing back against the analysts trying to convince conservatives and libertarians that a carbon tax is going to somehow be a boon to GDP growth.

Having said all that, the tax literature is also quite clear that a tax on capital is very destructive, much more so than taxes on labor income or on consumption (such as a VAT or sales tax). For example, there are standard results in the literature showing the conditions under which a zero tax rate on capital income is optimal, meaning that the government should rely on other tax sources to raise revenue. (To be sure, some economists would object to the assumptions underlying these results, but my point is that the starting point of the discussion is to justify why capital should be taxed at all.)

Back in 2008 Greg Mankiw wrote an article for the New York Times summarizing the case for cutting the corporate income tax.[1] He pointed out that because of the international mobility of capital, it’s actually American workers who bear the brunt of this tax—some 70 percent of the burden, according to a 2006 CBO study.

To address the counterargument of simply cutting taxes on workers, Mankiw explained, “The answer is that while most taxes distort incentives and shrink the economic pie, they do not do so equally. Compared with other ways of funding the government, the corporate tax is particularly hard on economic growth.” Mankiw then cited a 2005 CBO study that found the “distortions that the corporate income tax induces are large compared with the revenues that the tax generates.”

In this context, then, we are better able to interpret the RFF chart above. Precisely because taxes on capital are so destructive, relative to other ways of raising revenue, it is not shocking to see that if the revenues from a new carbon tax were devoted to reducing capital taxes, that the economy on net might enjoy faster growth. But to repeat, this is because cutting capital taxes is so helpful that it might offset the drag from a new carbon tax.

If what we want to do is promote economic growth, then of course an even better approach would be to cut capital taxes without imposing a new carbon tax.

Advocating the Impossible

Neeley’s main point is to chide me for being unwilling to advocate the politically impossible. In other words, if I admit that standard models such as the RFF one show the theoretical possibility of a carbon tax being used to fund capital tax cuts and hence deliver a “win-win,” why am I so skeptical about the whole project? After all, aren’t public intellectuals supposed to plant seeds today, in order to widen the options for policymakers down the road? As Neeley puts it:

More generally, lots of political ideas start out being unrealistic, only to become law later. People who advocate for Social Security privatization or drug legalization probably recognize the uphill struggle they face in advancing their views, but that hardly means they should just give up. As Milton Friedman famously said, the basic function of a policy advocate is “to develop alternatives to existing policies, [and] to keep them alive and available until the politically impossible becomes the politically inevitable.” I happen to think the time is a lot closer for revenue-neutral carbon taxes than Murphy probably does. But it’s only going to happen if people make the case. [Bold added.]

There are two main problems with Neeley’s block quotation. First, notice the part I put in bold. Neeley says he thinks we are going to see “revenue-neutral carbon taxes” a lot sooner than I give credit for. (I wonder why, since even British Columbia—the poster child on this issue—no longer counts, and the left flatly rejected a Washington State revenue-neutral carbon tax designed by an economist.)

But the whole point of my discussion was to say a revenue-neutral carbon tax is not enough. In other words, even if Washington State’s ballot measure had won, that would still not satisfy the RFF chart above, because the measure called for using receipts to cut the sales tax and give a rebate to working families. These are laudable things, but they wouldn’t be the blue line in the RFF chart. If this proposal failed, imagine what would happen if instead the Washington State ballot measure had proposed devoting just about all of the revenue to a tax cut for “working capitalists”?

Beyond Neeley’s reframing of the issue (making it about a “revenue-neutral carbon tax” rather than a “revenue-neutral carbon tax designed to benefit capitalists”), his analogies with Social Security and drug prohibition are qualitatively different from the carbon tax issue.

If a purist libertarian thinks that all drugs should be legalized, she can recognize that this is politically impossible. So such a person could consistently say, “I support full drug legalization, but I would be happy if the federal government respected the various states that allowed medicinal marijuana. Sure that’s not my ideal outcome, but it’s a move in the right direction.”

(Of course, IER is a think tank devoted to energy topics, but we are here speaking about a hypothetical libertarian perspective on drugs, as an analogy, since Neeley brought up the example in his discussion.)

Likewise, if a libertarian thinks the payroll tax on workers should be cut to 0%, she realizes this is politically impossible. But if a politician wants to cut the payroll tax in half, the libertarian could say, “That’s a step in the right direction.”

However, if a politician wants to introduce a carbon tax while cutting the payroll tax, in a way that doesn’t actually reduce the tax burden overall, but merely shifts it around, and in a way that actually hurts the economy on net, then why should the libertarian endorse such a move? It’s not a step in the right direction. It’s actually a step in the wrong direction.

Neeley wants to argue that if enough people endorse the knife-edge result of a new carbon tax coupled with a cut in capital taxes, that maybe that will be the outcome. Here all I can say is, “No it won’t.” And it matters a lot that falling short of the ideal ruins the whole case. In other words, a libertarian who wants full drug legalization could at least think allowing medicinal marijuana is better than the status quo. But someone who uses the RFF study and wants Neeley’s preferred carbon tax cut deal, does not think that just getting a portion of the capital tax cut is still better than the status quo. No, the RFF chart shows mixing in the other ideas—let alone spending any of the new revenues on “green” projects, which plenty of environmentalists want to do—makes the outcome worse than the status quo, if we are just considering GDP growth.

Conclusion

Oddly enough, I can turn Neeley’s argument against him. My ideal outcome is certainly not a huge new carbon tax, coupled with corresponding cuts to capital taxes. Rather, my ideal tax reform plan would involve large rate reductions without any new carbon tax.

And as Neeley himself said, the role of public intellectuals is to hold up ideals, to shape the debate. It is particularly ironic in this context, because I have been at conferences where people from R Street told me that my ideal of getting rid of top-down regulations on automobiles and power plants without a carbon tax, was politically impossible, and that that’s why I was supposed to support R Street’s proposal for a carbon tax to replace all of those regulations. I’m glad I can now point to Josiah Neeley from R Street, as vindication of my “purist” position.

[1] If you click the link to his NYT article, you’ll see that Mankiw first discusses the flaws of a corporate income tax, and then suggests replacing its revenue with a higher gasoline tax. I realize the irony given our discussion of a carbon tax swap, but Mankiw’s stance on gas taxes doesn’t affect any of my points above.

The post Responding to R Street on the Carbon Tax: When Does It Make Sense to Advocate the Impossible? appeared first on IER.

No comments:

Post a Comment