For decades, government and private interests have announced major breakthroughs with utility-scale (central station) solar. (Part II of this post will document these perennial exaggerations.) Such pronouncements belie the fact that solar has always been the most expensive and heavily taxpayer-subsidized source of grid electricity.

The latest hyperbole has come from the US Department of Energy’s Office of Energy Efficiency and Renewable Energy. Last week, EERE declared: “Largely due to rapid cost declines in solar photovoltaic (PV) hardware, the average price of utility-scale solar is now 6 cents per kilowatt-hour (kWh).”[1]

Really?

DOE’s own Energy Information Administration (EIA) estimates a five-year-out (2022) cost of utility-scale solar photovoltaic of 7.37 cents per kilowatt hour (2016 dollars)—and 5.81 cents per kilowatt hour after applying the Investment Tax Credit subsidy.[2]

EIA’s estimate, almost one-quarter higher than EERE’s, moreover, does not include hidden costs that must be incorporated for an apples-to-apples, quality neutral comparison of PV to conventional power generation. Such costs include an imposed cost due to solar power’s intermittency of over 3 cents per kilowatt hour and other hidden costs that can add an additional 2.5 to 5 cents per kilowatt to the cost of solar power, making central-station solar radically uneconomic compared to readily available alternatives, including natural-gas-fired generation.

Hidden Costs

Four major ignored costs for utility-scale solar (relative to fossil-fuel generation) are:

- Back-up/fill-in power (or storage) due to intermittency.

- Less operating life.

- Additional transmission costs.

- Special tax benefits.

Intermittency. Solar power’s intermittency arises from daytime clouds blocking the sun and at night (without storage, solar only provides power when the sun is shining). Even the sunniest city in the United States—Yuma, Arizona—has 50 cloudy days a year.

Because solar power peaks in the early afternoon and electricity demand peaks in the late afternoon or early evening, other technologies must compensate or expensive storage technologies (e.g. batteries) must be used to satisfy demand.

Last year, the Institute for Energy Research (IER) published a study that calculated the imposed costs for solar power assuming natural gas combined cycle and natural gas combustion turbines provided the back-up power.

The imposed costs totaled 3.08 cents per kilowatt hour in 2013 dollars (or 3.21 cents per kilowatt hour in 2016 dollars).[3] The study also showed that solar power’s imposed costs increase as more capacity is added to the system.

The purpose of the IER study was to calculate the cost of generating power from existing generating sources and compare that to the cost of generating power from new generating sources. It found that electricity from new solar is nearly 5 times more expensive than from existing nuclear sources, over 3.5 times more expensive than from existing coal sources, and 4 times more expensive than from existing combined cycle natural gas sources.

Transmission Solar power also requires more expensive transmission lines. When solar power surges, its peak power can be 4 or 5 times greater than average power. Power lines have to be sized to carry the surge despite delivering just average power. As a result, solar power lines are more expensive than the lines needed for traditional technologies.[4]

Operating Life Further, solar technologies are not expected to operate as long as traditional generating technologies. In its cost calculations, EIA assumes that all generating technologies have a financial life of 30 years. However, coal, natural gas, and nuclear plants have operating lives of over 50 years, while it is believed that the life of a solar plant will be on the order of 20 or 25 years.

Special Tax Favor

The solar industry is heavily taxpayer subsidized as noted above. Solar installations receive an investment tax credit that is as large as 30 percent of the initial capital investment. In other words, a $1 billion project would have a tax credit of $300 million.

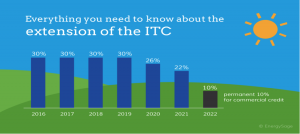

At the end of 2015, Congress extended the investment tax credit, which was about to be sunset. The solar investment tax credit was extended through 2021, remaining at 30 percent through 2019 and then lowered as noted in the graph below. In 2022, it will be reduced to zero for residential projects and to a permanent 10 percent for commercial projects, unless Congress again changes the tax benefit.

Clearly, the Investment Tax Credit is important to the future of solar as this industry lobbied Congress heavily for the extension.

Source: http://news.energysage.com/congress-extends-the-solar-tax-credit/

Solar also preferentially benefits from

- Accelerated depreciation (5-year depreciation for solar equipment, which can only be applied to 85 percent of the cost if the investment tax credit is taken)

- DOE loan guarantee program (which guarantees loans for large projects),

- State property and sales tax exemptions (38 states offer property tax benefits and 29 states offer sales tax exemptions), and

- State quotas for solar energy established as part of a state’s renewable portfolio standard.[5]

Capacity Value

Another hidden problem with solar is that its capacity value diminishes as more supply is added to the grid. Capacity value measures the ability of a supply source to reliably meet demand. It is a crucial concept in helping grid operators make sure they have enough generation resources available to meet total customer demand under all scenarios and particularly during times of highest demand.

In a recent study, IER found that at low penetration levels, solar production could reduce stress on the electrical grid. However, using data from California, the study showed that when solar PV exceeded a 6-percent market share, the capacity value of additional solar power fell to zero.[6] As a result, back-up power must be maintained on the system, which results in the imposed cost noted earlier.

Conclusion

Press releases about alleged breakthroughs and goal attainment cannot substitute for market verdicts where transactions are voluntary and government neutral. Grid-ready solar remains uneconomic—and radically so. If solar is truly becoming competitive, then taxpayers should be removed to level the playing field for all competing (and improving) technologies.

[1] U.S. Department of Energy, R&D will include focus on reliability, resilience, and storage, September 12, 2017, https://energy.gov/articles/energy-department-announces-achievement-sunshot-goal-new-focus-solar-energy-office

[2] Energy Information Administration, Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2017, Table 1b, April 2017, https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

[3] Institute for Energy Research, The Levelized Cost of Electricity from Existing Generation Sources, June 2016, http://instituteforenergyresearch.org/wp-content/uploads/2016/07/IER_LCOE_2016-2.pdf.

[4] The True Cost of Solar Electricity, August 12, 2017, http://www.climateviews.com/uploads/6/0/1/0/60100361/solarfraudstudy.pdf

[5] The True Cost of Solar Electricity, August 12, 2017, http://www.climateviews.com/uploads/6/0/1/0/60100361/solarfraudstudy.pdf

[6] Institute for Energy Research, The Solar Value Cliff, August 2017, http://instituteforenergyresearch.org/wp-content/uploads/2017/08/The-Solar-Value-Cliff-August-21-1.pdf

The post Utility-Scale Solar: Subsidies and Hidden Costs Make It Still Uneconomic appeared first on IER.

We offer solar panel services Solar Panels the Woodlands TX.

ReplyDeleteWe are a solar panel company Solar Panels Pasadena.

ReplyDelete